Hospital Monopolies Are What’s Wrong with American Health Care

Call it a sign of the times. If Rich Uncle Pennybags (a.k.a. “Mr. Monopoly”) appeared today, he would have little interest in holding properties like the Short Line Railroad. In the 21st century, acquiring railroads, or even utilities, is so Baltic Avenue. The real money—and the real monopolies—lie in health care, specifically in hospitals.

Despite the constant focus on prescription drug prices, pharmaceuticals represent a comparatively small slice of the American health care pie. In 2016, national spending on prescription drugs totaled $328.6 billion. That’s a large sum on its own, but only 9.8 percent of total health care spending. By contrast, spending on hospital care totaled nearly $1.1 trillion, or more than three times spending on prescriptions.

Hospitals’ Monopolistic Tactics

The Journal profiled several under-the-radar tactics that some large hospitals use to deter competition and pad their bottom lines. For instance, some contracts “prevent patients from seeing a hospital’s prices by allowing a hospital operator to block the information from online shopping tools that insurers offer.”

Hospitals use these tactics to oppose transparency, because they fear, correctly, that if patients know what they will pay for a service before they receive it, they may take their business elsewhere. It’s an arrogant and high-handed attitude straight out of Marxism.

Also in hospitals’ toolkits: So-called “must-carry” clauses, which require insurers to keep their hospitals in-network, regardless of the high prices they charge, or poor quality outcomes they achieve. The Journal reported that one of the nation’s largest retailers wanted to kick out the lowest-quality providers, but had no ability to do so.

Officials at Walmart a few years ago asked the insurers that administered its coverage…if the nation’s largest private employer could remove from its health-care networks the 5% of providers with the worst quality performance. The insurers told the giant retailer their contracts with certain health-care providers didn’t allow them to filter out specific doctors or hospitals, even based solely on quality measures.

Surprise! Obamacare Made It Worse

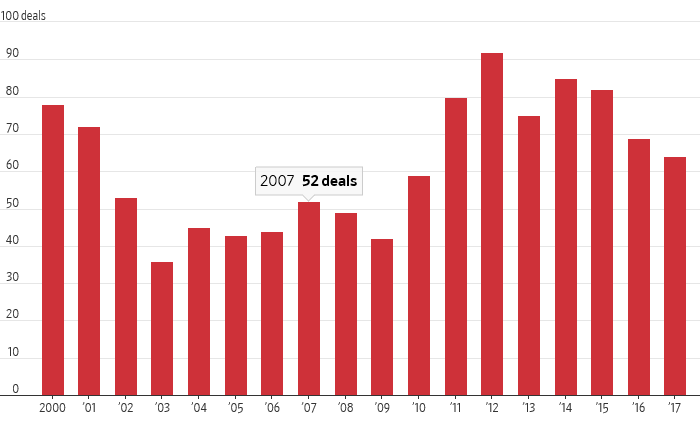

Many of these trends preceded President Obama’s health care law, of course. But it doesn’t take a PhD in mathematics to see how hospital mergers accelerated after 2010, the year of Obamacare’s passage:

Hospitals responded to the law by buying up other hospitals, increasing market share in an attempt to gain more negotiating “clout” against health insurers. That leverage allows them to demand clauses such as those preventing price transparency, or preventing insurers from developing smaller networks that only include efficient or better-quality providers.

Here again, industry consolidation begets higher prices. In many cases, hospitals can charge more for services provided by an “outpatient facility” as opposed to one provided by a “doctor’s office.” In some circumstances, the patient will receive the same service, provided by the same doctor, in the same office, but will end up getting charged a higher price—merely because, by buying the physician practice, the hospital can reclassify the office and procedure as taking place in an “outpatient facility.”

Remember: Hospitals Endorsed Obamacare

In 2010, the American Hospital Association, along with other hospital associations, endorsed Obamacare. At the time the hospital lobbies claimed that the measure would increase the number of Americans with health insurance coverage. For some reason, they neglected to mention how the law would also encourage the consolidation that presents ever-upward pressure on insurance premiums.

But remember too that Obama repeatedly promised his health-care law would lower premiums by $2,500 for the average family. Unfortunately for Americans, however, Obamacare’s crony capitalism—allowing hospitals to grow their operations, and thus their bottom line, in exchange for political endorsements—continues to contribute to higher premiums, putting Obama’s promise further and further away from reality.

This post was originally published at The Federalist.