Obamacare Brings Higher Premiums

From consultants at Aon Hewitt today comes word that premiums for employer-sponsored coverage continue their upward spiral, and are projected to rise by another 7 percent in 2012. Employee out-of-pocket costs will see even more of an increase; as the New York Times reported, the Aon Hewitt study found that employees’ share of premiums will rise by an even greater amount, nearly 11 percent.

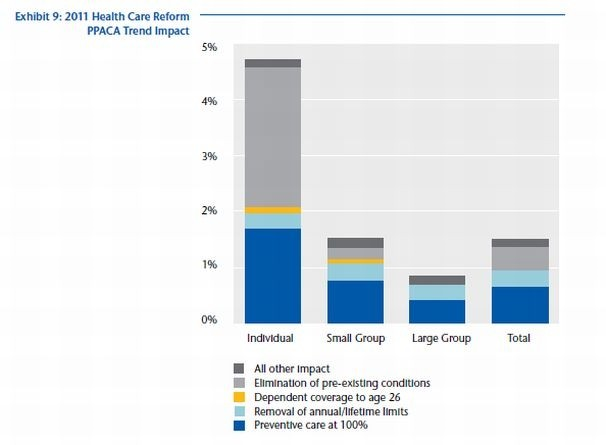

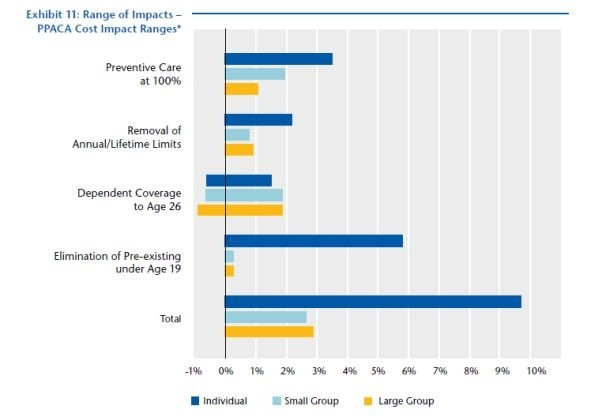

Meanwhile, another recent study by consultants at Aon analyzed the reasons for recent premium increases, including the direct costs associated with changes mandated by Obamacare. (It’s also worth noting that the study likewise concluded that indirect effects – like cost-shifting from government plans to private ones as a result of lower Medicare payments – “could have material indirect effects on [cost] trend,” but declined to estimate these impacts.) The Aon paper noted that the average premium increase due to Obamacare mandates will “vary significantly by line of business,” with a “wide range of reported impacts.” Specifically, the study found that premiums in the individual market will rise by an average of nearly 5 percent just due to Obamacare – and by nearly 20% overall. The range of estimates were even higher – some individual plans reported premium increases of more than five percent due to one mandate alone (the elimination of pre-existing condition exclusions for children), and double-digit impacts overall. (See the charts below for more details.)

The study raises several key issues:

- First, the individual market is perhaps the truest market for health insurance; because most purchasers in the individual market buy insurance using after-tax dollars, and don’t have their premiums subsidized by an employer, they’re purchasing what they need to buy, as opposed to what they want to buy. This survey and others have reinforced how individuals are being forced to buy more insurance than they need or want thanks to Obamacare – and are paying for the privilege of doing so.

- This year’s increases are only a start. The Congressional Budget Office concluded that the mandates in the law will raise premiums in the individual market would rise by up to 30 percent. The fact that some plans are already reporting double-digit premium increases as a result of implementing the relatively minor changes that Obamacare mandated this year does not bode well for 2014 and future years.

- When Secretary Sebelius wrote to insurers last year threatening retaliation for alleged “misinformation and unjustified rate increases,” she was attempting to ignore the reality that premiums vary widely by product, meaning the stories of large Obamacare-premium related increases that prompted her intervention last September were neither unexplained nor unexpected.

Regardless of how much insurance policies are going up, the fact remains that premiums are rising inexorably higher, as today’s report by Aon Hewitt and last week’s Kaiser Family Foundation study documented. Yet candidate Obama repeatedly promised to lower premiums by $2500 per year per family, and to do so within his first term. So by any standard, these studies once again contrast Obama’s rhetoric with the failed Obamacare reality.